Blog Post:

In vitro fertilization (IVF) has become a popular option for couples struggling with infertility. This assisted reproductive technology has helped millions of couples worldwide to conceive and start a family. However, the process of IVF can be expensive and often comes with its own set of risks. This is where insurance plays a crucial role in making IVF more accessible and affordable for couples. In this blog post, we will discuss the role of insurance in IVF and what you need to know about it.

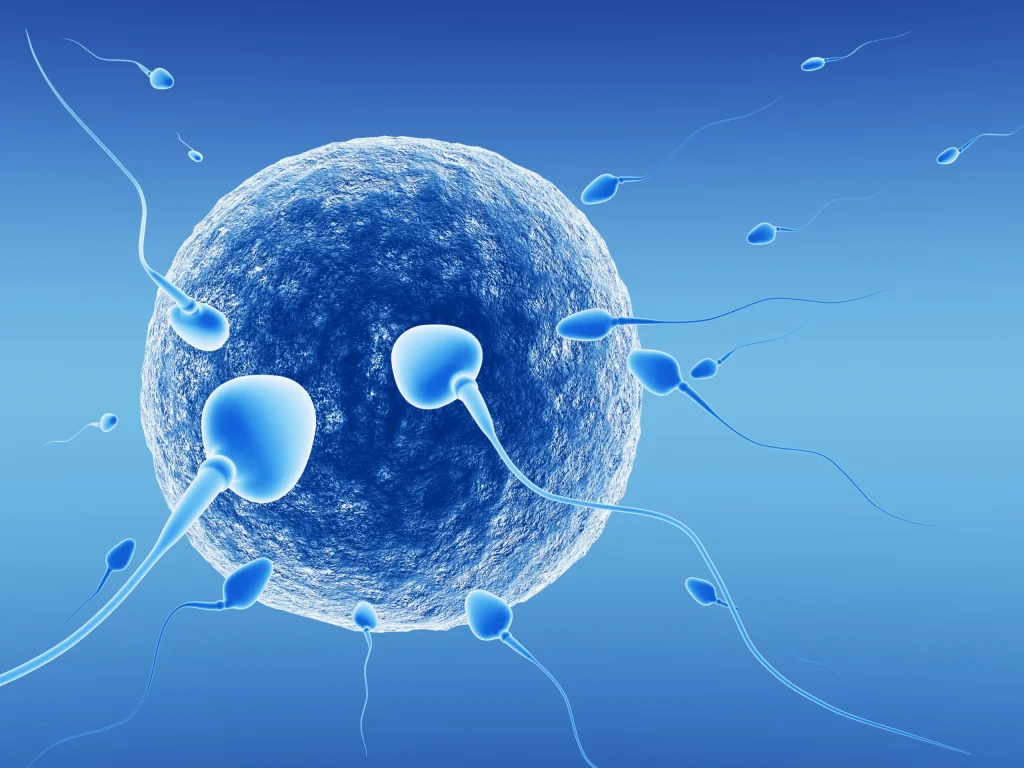

What is IVF?

In vitro fertilization, commonly known as IVF, is a type of assisted reproductive technology (ART) used to help couples conceive a child. The process involves retrieving eggs from a woman’s ovaries and fertilizing them with sperm in a laboratory. The fertilized eggs, now called embryos, are then transferred back to the woman’s uterus, where they can hopefully implant and result in a pregnancy.

Why Do Couples Need Insurance for IVF?

IVF is a complex and expensive process that requires multiple rounds of treatment in most cases. The average cost of one IVF cycle in the United States is around $12,000, with additional costs for medications, consultations, and other procedures. For couples struggling with infertility, this can be a significant financial burden. Insurance coverage for IVF can help alleviate some of this burden and make the process more accessible for those who need it.

Types of Insurance Coverage for IVF

There are different types of insurance coverage for IVF, and it’s essential to understand the differences between them.

1. Employer-Sponsored Health Insurance

Some employers offer health insurance plans that cover IVF treatments. This type of coverage varies from company to company, so it’s crucial to check with your employer to see if they offer this benefit. However, even if your employer provides insurance coverage for IVF, it may not cover the entire cost. You may still be responsible for co-pays, deductibles, and other out-of-pocket expenses.

2. Individual Health Insurance Plans

Individual health insurance plans, also known as private health insurance, may offer coverage for IVF. However, this type of coverage is not as common as employer-sponsored health insurance. You will need to review the specific details of your plan to determine if it covers IVF and to what extent.

The Role of Insurance in IVF: What You Need to Know

3. Discounted IVF Programs

Some fertility clinics offer discounted IVF programs for patients without insurance coverage. These programs usually have a fixed price and include all necessary procedures and medications. However, they may not include additional treatments such as genetic testing or egg freezing.

4. State Mandated Insurance Coverage

Currently, 19 states in the US have laws that mandate insurance coverage for infertility treatments, including IVF. These states include Arkansas, California, Connecticut, Hawaii, Illinois, Louisiana, Maryland, Massachusetts, Montana, New Hampshire, New Jersey, New York, Ohio, Rhode Island, Texas, Utah, and West Virginia. These mandates vary from state to state, so it’s essential to check with your insurance provider to determine what is covered.

Factors to Consider When Choosing Insurance Coverage for IVF

When considering insurance coverage for IVF, there are a few factors to keep in mind:

1. Coverage Limitations: Many insurance plans have limitations on the number of IVF cycles they will cover. It’s essential to understand these limitations and how they may affect your chances of success.

2. Age Restrictions: Some insurance plans may have age restrictions for IVF coverage. For instance, they may only cover treatments for women under a certain age, typically between 30-40 years old.

3. Pre-Existing Conditions: Some insurance plans may not cover IVF if you have a pre-existing medical condition that affects fertility. It’s crucial to review your plan to determine if any pre-existing conditions may affect your coverage.

4. Out-of-Network Providers: Some insurance plans may only cover IVF treatments at specific fertility clinics or providers. If your preferred clinic is not in-network, you may have to pay out-of-pocket for the treatment.

In summary, insurance coverage for IVF can help ease the financial burden of this complex and expensive process. However, it’s essential to understand the different types of coverage and any limitations or restrictions that may come with it. It’s also crucial to review your insurance plan carefully to determine what is covered and what is not.

In conclusion, IVF can be a life-changing option for couples struggling with infertility. However, the cost can be a significant barrier for many. Insurance coverage for IVF can make this process more accessible and affordable for those in need. It’s crucial to understand the different types of insurance coverage and factors to consider when choosing a plan. With the right insurance coverage, couples can focus on their fertility journey without the added stress of financial burden.

SEO Metadata: